Getting a Mortgage in Spain.

Marbella offers more than just its stunning beaches. Despite its worldwide fame for its golden shores and warm Mediterranean waters, the city has diverse activities to enjoy beyond the coast. If you prefer to steer clear of the sand, there are plenty of things to do in Marbella.Would you like to live in this slice of paradise by the Mediterranean Sea.

Banks usually have distinct criteria when offering mortgages to foreigners compared to citizens and residents. Discover how to secure it:

Obtaining a Mortgage in Spain: A Guide for Foreigners and Non-Residents

If you’re a foreigner or a resident seeking a mortgage in Spain, be prepared to submit extra documents like work contracts, proof of income, and tax returns. Typically, foreigners will need to pay at least 20% of the property’s total cost as a deposit and demonstrate a steady source of income.

Non-residents can also access mortgages in Spain.

You might qualify if you’re a non-resident in Spain looking for a mortgage, but the specific terms will differ among lenders. A pivotal factor distinguishing residential from non-residential loans lies in the maximum loan-to-value (LTV) accepted by banks. For non-residents settling their taxes outside Spain, the maximum mortgage amount typically ranges from 60% to 70% of the purchase price. On the other hand, fiscal residents, dutifully paying Spanish taxes, can usually borrow up to 90% of the property’s value. Other conditions might include meeting a minimum income threshold and demonstrating sufficient funds to cover mortgage payments. Additionally, having a valid residence permit may be necessary.

Securing Mortgages for Properties in Spain: A Guide for US and EU Citizens

In Spain, numerous mortgage providers offer overseas property loans tailored explicitly for non-residents. You’ll likely need to furnish proof of income and other financial details to secure such a mortgage.

Among the well-known mortgage providers in Spain are Banco de Sabadell, BBVA, CaixaBank, and Banco Santander. Before applying, it’s crucial to research each lender thoroughly and compare interest rates, terms, and conditions to find the best fit for your needs.

Obtaining a Spanish Mortgage for UK Residents

Regrettably, Spanish mortgages are not accessible to UK residents as Spanish banks have specific eligibility criteria. However, UK residents can still purchase property in Spain and seek financing from lenders based in the UK.

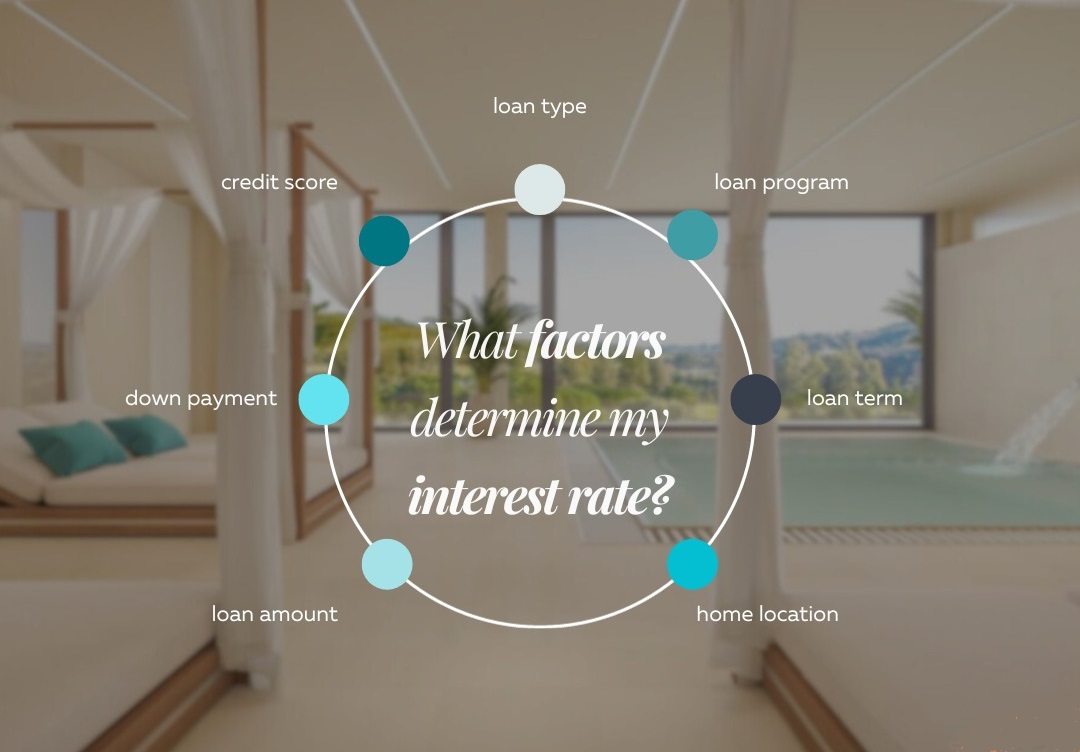

Understanding Spanish Mortgage Rates: Interest Rates for Home Loans in Spain

The average mortgage rate in Spain is 1.48%, making it lower than the United States’ average rate. For more details and the latest rates, feel free to contact us.

Remember that mortgage rates for foreigners or non-residents might differ, so the best way to stay informed is by contacting us.

Utilize a Spanish Mortgage Calculator: Estimate Your Loan Repayments

You can find several Spanish mortgage calculators online, and some of the popular options are: BBVA Mortgage Calculator, Caja Madrid or Bankia offer convenient, user-friendly mortgage calculator that assists users in computing their the overall cost and determine their mortgage loan and monthly payments.

For the most accurate and reliable calculation of your monthly mortgage payments and to ensure a smooth process of obtaining a mortgage in Spain, reach out to our local real estate agents. With their expert guidance, you’ll make progress swiftly and confidently.

Securing a Mortgage as a Foreigner in Spain: The Process and Required Documents

In Spain, getting a mortgage follows a process similar to other countries. To apply, individuals must submit a valid ID (like a passport or Spanish ID), show proof of income and employment history, and demonstrate they have enough funds to cover the mortgage expenses.

Moreover, you’ll need to provide a copy of the property’s current deed. Based on their evaluation, the bank or lender will assess the property’s value and determine if the loan is appropriate for you.

Once approved, the applicant must pay an initial deposit, typically about 20% of the property’s purchase price. Additionally, there’s a processing fee for the mortgage application required by the bank. Afterward, the applicant will sign the mortgage deed, which contains all the terms and conditions of the mortgage agreement.

Before finalizing the mortgage, the applicant must sign the document before a notary and two witnesses. The Notary will officially validate the deed, and the witnesses will confirm that the applicant comprehends the outlined terms and conditions. After the mortgage deed is signed and approved, the bank will send the money to the seller or developer, and the purchase process will be completed.

LuxuryForSale.Properties Real Estate.

Our team is our most valuable resource, We operate with a dedicated team, serving clients through the Costa del Sol comprising Property Advisors, Architects, and Project Managers. Each member has been carefully chosen for their exceptional skills and experience in Architecture, Real Estate, After-Sales, Finance, Investment, Marketing, and other relevant fields.

We take pride in our multilingual capabilities, with proficiency in over 12 languages, enabling us to provide unmatched service backed by extensive knowledge and professionalism. Our agents possesses remarkable negotiation expertise and a proven track record of closing successful sales. With decades of experience, they employ many effective marketing strategies to guarantee a swift and lucrative sale for your property.